5 Grant Application Errors That Could Hurt Your Chances (and How to Fix Them)

Grant funding has become a strategic edge in 2025 – no longer a “second-rate” option but a powerful enabler for innovation, expansion, and sustainability.

Yet, the path to securing grants is riddled with pitfalls. Many businesses, even experienced ones, stumble during the application process, risking rejection, missed deadlines, or wasted effort.

In our experience, working with over 1,000+ grant applications since 2014, here are the five most common mistakes we see – and practical ways to avoid them.

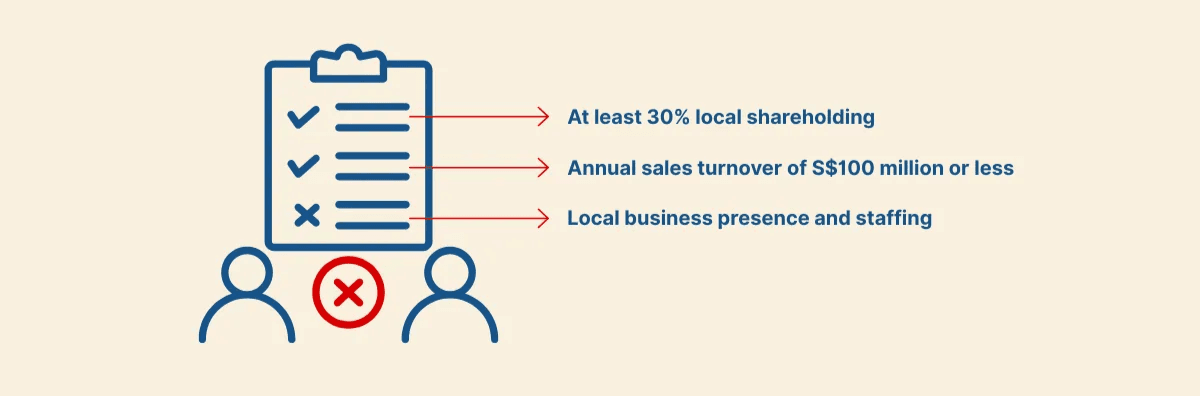

1. Overlooking Eligibility & Compliance Conditions

Over 80% of unsuccessful applications stem from a lack of preparation and misunderstanding of basic eligibility

Grants come with strict compliance rules, and failure to meet these can disqualify your application even after approval.

One of the most frequent trip-ups?

Mismanaging local shareholding thresholds.

Take the popular Enterprise Development Grant (EDG) as an example – applicants must maintain a minimum level of Singaporean ownership throughout the grant period. If your business undergoes equity fundraising or changes in leadership (e.g. co-founder exits) before the claims process wraps up, you might unknowingly breach eligibility and lose access to funding.

Startup-focused programs like Startup SG Tech or Startup SG Founder add more layers: at least two Singaporeans or PRs must hold key decision-making roles. Therefore, if a co-founder exits or a new co-founder onboards, the company might fall below ownership or control thresholds, and similarly face the nullification of the original grant offer.

Here’s what you can do

Confirm your current shareholding structure, including nationalities

If raising funds, ensure new investors won’t dilute local ownership below the required threshold

Maintain local business presence and staffing throughout the grant’s lifecycle

For startup grants, double-check age limits, IP ownership, and innovation requirements

If unsure, consult a professional (we work with grant consultancy partners in Hong Kong & Singapore)

2. Poor Scope Alignment & Budget Planning

If your budget doesn’t match the grant’s scope, your application may be disqualified – or you’ll need to self-fund the gaps

Grants can be highly specific about their support for specified cost categories: for example, “third-party consultancy fees”, “software and equipment”, and “internal manpower cost”. Expenses outside these (e.g. routine operating costs, unrelated software) are ineligible.

In one instance, a company budgeted $20,000 for cloud services under an EDG Automation project. However, they later discovered that operational cloud infrastructure costs were not eligible for funding. As a result, they were left with a solution that was actually more expensive than what they would have chosen without the grant. Ultimately, the company decided to withdraw their grant application and reconsider their approach to project funding, with major time-related costs.

So, make sure your application includes detailed financial statements, a solid business plan, and all required supporting documentation.

Here’s what you can do

Align your budget with the fundable items listed by the grant, including contingencies (if needed)

Secure detailed vendor quotes for all purchases; many grant applications require unit costs and detailed quotes

Avoid generic software unless it's explicitly approved

Use Grantbii to help you catch non-eligible items and produce a coherent costing schedule

3. Failing to Align Project Goals to the Right Grant Objectives

Each grant scheme has clear objectives.

In the 2 previous grant examples that we have used in the article, EDG focuses on productivity and innovation, while Startup SG Tech supports early-stage R&D.

Yet, we still see applications that focus heavily on basic tools or generic goals (Psst! were you looking for PSG grants?). For example, we came across one firm that pitched a CRM deployment as a “transformation project.” It didn’t pass – and wasted both time and budget.

Here’s what you can do

Read and reflect the grant’s desired outcomes; apply the 80/20 rule: 80% of your proposal should link directly to the grant’s goals

Remove or minimize discussion of elements that fall outside scope

Use grant-specific language in your narrative (e.g. “30% productivity uplift,” “automation of X process,” “penetration into new markets”)

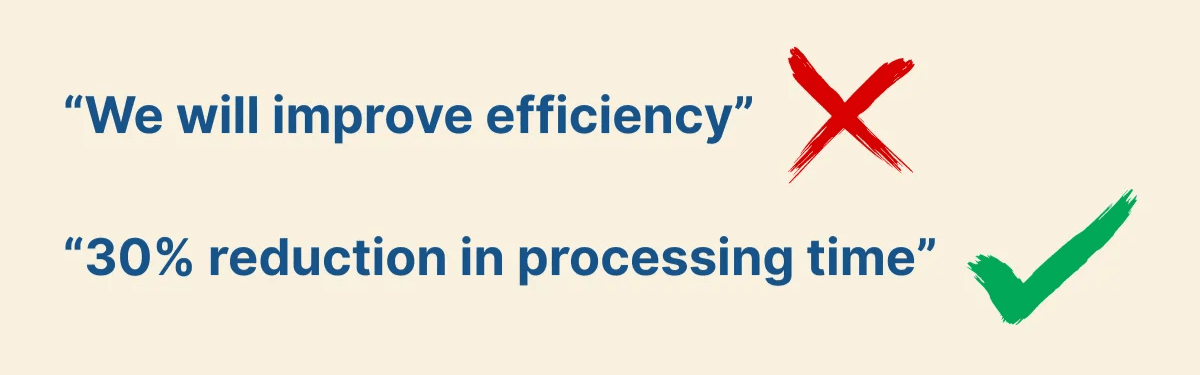

4. Presenting Vague, Unquantifiable Outcomes

Without numbers, your proposal becomes speculation

Official claim guidelines often require applicants to project figures such as revenue, staff levels, profit, and worker impact (e.g. training, job creation). After all, grants are investments – and agencies expect returns in the form of tangible outcomes: revenue, profit, jobs created, productivity.

Did you know that worker impact & productivity is a top priority in Singapore in 2025?

Simply stating that “we’ll improve efficiency” is not enough for a successful grant proposal. This kind of ambiguity makes it difficult for evaluators to assess the true value of the project. Therefore, if you claim a new system will save staff time, but don’t specify how much time or how many hours will be saved each week, reviewers can’t properly evaluate the return on investment.

The more concrete your projections, the stronger your case:

How much time will be saved? Will your new system reduce processing time by 30%?

How will headcount or job roles evolve? Does this result in a 50% increase in profitability? Over what period?

What increase in profit is projected? Does that translate to freeing up two hours per employee per day?

Here’s what you can do

Define baseline metrics (current productivity, revenue, etc.)

Set specific, measurable targets for your project’s impact (e.g. “30% reduction in processing time,” “$200K revenue increase”)

Wherever available, use the official templates as a guide

Include charts or tables if needed to summarize “Before vs After” scenarios

Document the assumptions behind each number so you can substantiate them during evaluation or audit

This quantifiable approach not only clarifies your case but builds confidence internally that the funding will deliver measurable returns for the organization.

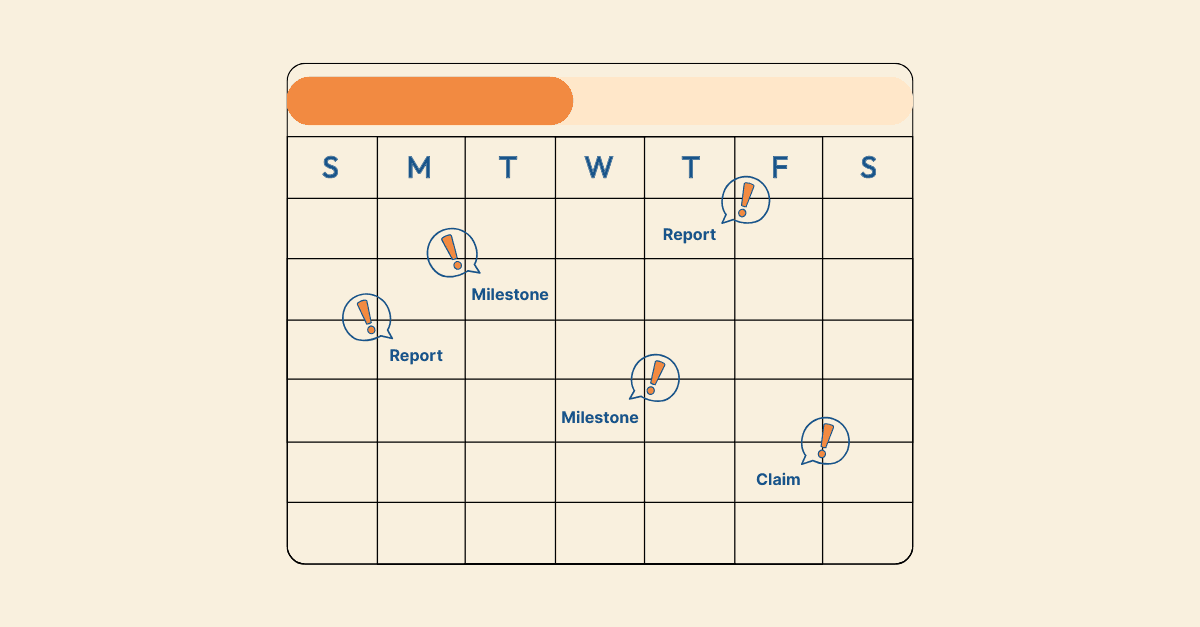

5. Underestimating Time Commitment & Post-Approval Obligations

From our experience, 1 in 5 rejections stem from missing supplementary deadlines or poor documentation

Many businesses wrongly assume that once they’ve submitted, their work is done. But grant success involves ongoing commitments:

Responding to clarification requests quickly

Submitting claims and progress reports on time

Preparing for audits and site visits

Managing a structured project timeline and milestones

For example, EDG requires projects to finish within the “qualifying period”, usually up to 24 months, while another popular grant – Market Readiness Assistance – has a stricter 12-month cap.

Here’s what you can do

Build a grant project calendar from day one

Assign a dedicated grant lead to manage deliverables and deadlines; set aside time for final reports, audits, and financial reconciliations

Track expenses meticulously – and ensure they align with approved costs (as defined in the Offer Letter).

Submit claims promptly, and maintain open lines with your Grant Officer; when facing challenging deadlines, request an extension proactively

Treat the grant like a contractual obligation, not just free money

Final Takeaway

Applying for grants can feel like navigating a maze – but it doesn’t have to be.

With the right preparation, clear objectives, and ongoing commitment, you can unlock significant non-dilutive capital to fuel your business growth.

And, if you’re still not sure where to begin 👉 Grantbii can help

Startups

Cyberport vs HKSTP (2025): Which Hong Kong innovation hub fits your startup?

Lewis Lee

Nov 11, 2025

Startups

Hong Kong Startup Funding Path: Which Cyberport / HKSTP Programmes, When?

Lewis Lee

Oct 29, 2025

Application Tips

How to Build a Strong Grant Proposal: The Anatomy of a Winning Application

Jemine Ngo

Sep 29, 2025